Hope Strengthens Foundation is now set-up to receive contributions from many of the top donor-advised funds in the nation, including Fidelity Charitable and Schwab Charitable.

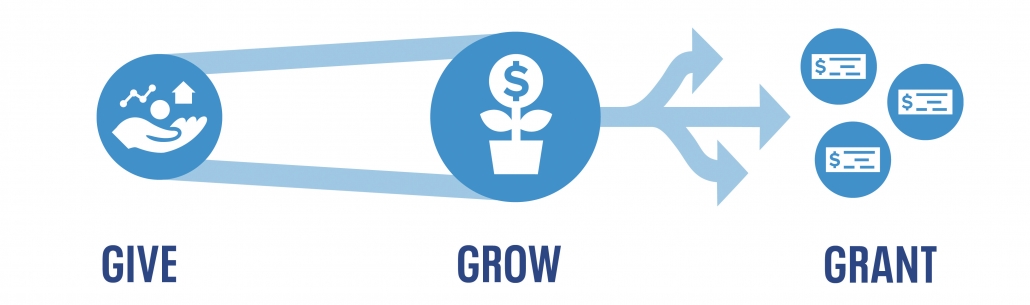

A donor-advised fund (DAF) is an investment account for philanthropic giving that offers an immediate tax benefit and the flexibility to support preferred charities like ours right away or over time.

In the face of a global pandemic, many donors may be searching for a way to expand their giving portfolio and make a positive impact in the communities they work and live. With a tax-efficient gift to Hope Strengthens Foundation, donors will support us in delivering targeted financial support to individuals and families facing a life-threatening illness, disability, or recovery from traumatic injury.

Advantages of giving through your DAF

- Simplicity: Your sponsoring organization handles all record-keeping, disbursements (including an option for automatic distributions), and tax receipts and provides you with a single document at tax time.

- Timing: You can request that a donation be made at any time or make automatic recurring gifts on a schedule of your choice.

- Open to all: Individuals, families, companies, foundations and other entities can start a DAF.

- Increase your philanthropic capital: With varying investment strategies available, the funds in your DAF have the potential to grow tax-free.

- Flexible funding options: Fund your DAF with the assets of your choice, including cash, stock, securities, and even real estate.

To make a donation to Hope Strengthens Foundation through your DAF, please contact your sponsoring organization. If your DAF is through Fidelity Charitable, Schwab Charitable or BNY Mellon, please visit the following link:

If you have any questions, please don’t hesitate to let us know. We can be reached at: info@hopestrengthens.org